Rebranding itself Early Salary has now become a brand to be known as Fibe. It is a one-stop solution to meet all your credit needs. Offering Instant loan services up to 5 lakhs, it has become popular among the people now.

Let us check out how to apply for the loan, and the advantages and disadvantages of Fibe.

More About Fibe

Fibe offers various loan services such as:

- Instant Cash Loan: Starting from Rs. 5,000 – Rs. 5,00,000, which can be paid in a tenure of 24 months.

- Personal Loans: You can apply for loan hassle-free online by following all steps as directed and meeting your financial needs. Inclusions are automotive, education, consumer durables, wedding and home renovation loans.

- Employer Tie-Up: By partnering with the employer, Fibe helps in fulfilling financial support for employees such as Instant Salary Advance, Medical Expenses, School Fees Financing and financial seminars.

Features and Benefits of Fibe Instant Cash Loan

- Offering flexible loan amounts from Rs 5,000 to Rs 5,00,000, one can apply for the loan digitally without going through a hectic paper process and the services are available 24*7.

- It is also quick and secure with PCI DSS-based app.

Steps To Apply For Instant Cash

To meet all your financial needs, you can check your eligibility within the app, follow easy steps and get an instant loan. It requires minimal and quick documentation, easy application and hassle-free approval.

- First, download the Fibe app, it is available for both Android and iOS smartphones.

- Check Eligibility: The Fibe app has flexible eligibility criteria, which makes it easier for anyone to meet the needs to apply for an instant cash loan.

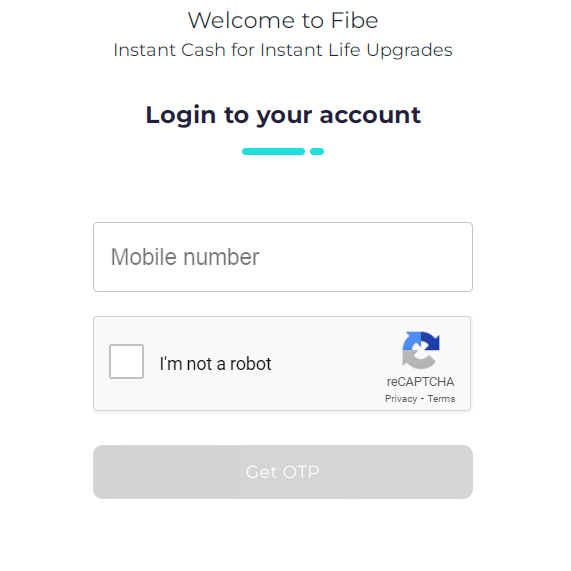

3. Login: Login by entering your mobile number and OTP. Further fill in correct and full details as per your documents including full name, email id, address, photo, company name and bank account number.

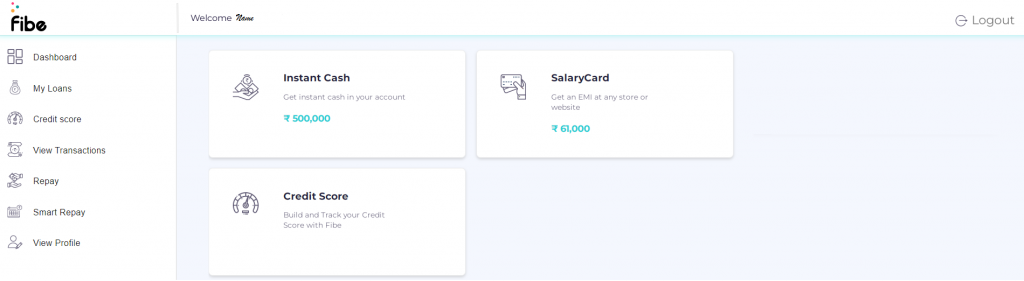

A dashboard will appear next where-in you complete or edit your details. Check loan calculator, instant KYC, upgrade the limit and so on.

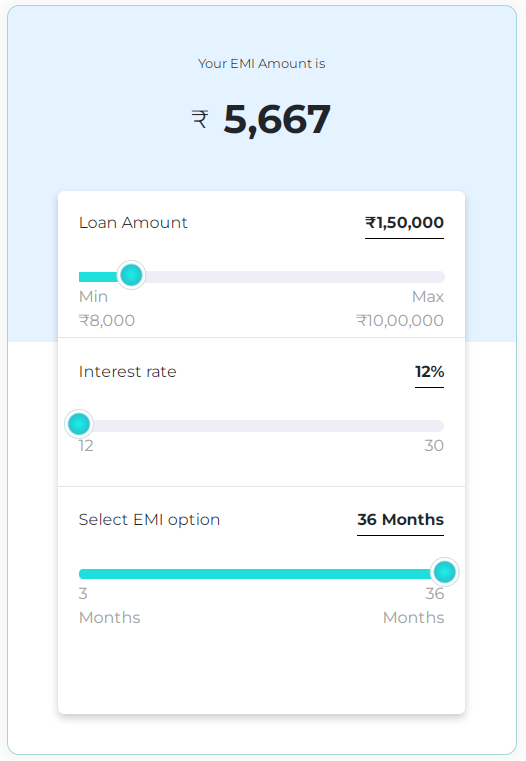

4. Calculate Loan EMI Online: You can very conveniently calculate your EMI and tenure of repayments online on the app itself against the loan you wish to apply for. In simple steps, you can get calculations in no time. And, it has interest rates as low as Rs 9 per day.

And, if you decide to prepay your loan amount then you can do that without even paying any additional charges.

5. Submit Your Documents

Now, you have calculated the loan amount, minimal documentation process to be completed without any manual efforts.

- Passport size photo – PAN Card – KYC documents as proof of address.

- For KYC you can either submit the Adhaar Card, Driving licence, Passport or Voter ID (front and back both).

- 3 months bank statement.

Note: Ensure all the documents are to be uploaded in pdf form and are self-attested.

6. Loan Approval Status and Apply For Loan Amount

- Within a few minutes, you will get a notification on your loan status and based on the required criteria of Fibe your loan status will be approved.

- On receiving the approval, select the decided loan amount and in no time you will receive the loan in your account.

Visit fibe.in to apply.