It seems like everyone has a PayPal account, but most people think of it as a way to transfer money or even use it as a digital wallet. You’d be silly to completely forget about PayPal for business purposes, because it has always been, and continues to be, one of the sleekest options out there. However, in these PayPal reviews, we’re going to take a look at what PayPal has to offer for business credit card processing. Sure, you could utilize the system as a freelancer and collect payments for your services, but this is an entirely different type of transaction.

For more PayPal reviews from our readers check out the comments area.

Our goal here is to consider the rates provided through PayPal, how well it integrates with other systems and how many types of credit cards can go through.

The good part about PayPal is that it keeps no secrets in terms of its pricing and fees. This is one of the main reasons the user count has consistently increased since PayPal’s inception. You can get setup within minutes, and the early termination fees are non-existent.

There’s much to lick your lips about with PayPal, so let’s take a deeper look to understand exactly how much you’re going to be spending, and what types of businesses should be using PayPal.

PayPal Reviews: Top Features

Several plans and services are offered through PayPal. Although it can see a little confusing, the list below should help guide you through the selection process.

- PayPal Express Checkout – A simple addon for companies that accept regular credit cards another way.

- PayPal Payments Standard – This one is a basic payment processing plan, which works for companies that aren’t currently accepting credit card payments. It gives you the functionality to do so.

- PayPal Payments Pro – Pro provides a hosted checkout on your own website.

- PayPal Here – This is the mobile app for collecting payments on the go.

- Virtual Terminal – The terminal is for collecting mail and phone orders, and it costs $30 per month.

- Digital Goods – For setting up things like recurring payments.

- Bill Me Later – Unique to PayPal, this feature offers no interest financing to customers.

- Online invoicing – Freelancers and contractors can send out quick invoices for the services they perform.

PayPal Reviews: Ease of Use

Is PayPal easy to use? Anyone who uses PayPal will laugh at that question, because, yes, it’s insanely easy to use. That’s what the whole platform was built on. You can grab a simple PayPal button and start selling products from any website. Even if you don’t have a shopping cart, the PayPal button is going to take care of everything for you.

The mobile app is just as smooth as Square, and they give you a free swiper to plug into your phone’s headphone jack. Another area that impresses us is the reporting. Whether you collect money through your online store or on a mobile interface, all of the transactions are going to end up in one place. It’s managed through a browser dashboard, and you can export the reports to make predictions for the years and months ahead.

PayPal Pros and Cons

PayPal stands out as one of the best-known solutions for managing transactions in today’s digital world. However, just because a solution is popular – doesn’t mean that it’s going to be the right option for every business.

PayPal makes it easier for customers to make secure purchases online without having to rely on their bank account. However, it’s also possible to tie a debit card or credit card into an account in case you run out of PayPal credit. This makes PayPal one of the more reliable choices for a virtual money transfer. At the same time, however, it lacks in some areas.

PayPal customers are constantly complaining about the company’s lack of customer support, and issues with high-risk industries, among other things. Some of the most common pros and cons worth noting about PayPal are:

| PayPal Pros | PayPal Cons |

| Trusted by consumers around the world One of the most popular ways to make a payment online Predictable pricing with flat rates to suit your budget Various pricing plans available Support for selling via subscriptions and recurring payments Support for a lot of different currencies – and international sellers Great developer tools for integrations and growth Extensive integrations with countless eCommerce tools Ideal for low volume merchants who don’t take too many payments Suitable for an all-in-one payment system Ties into accounting and financial tools Suitable for use via mobile devices Available hardware and card readers Options for Borrowing money and capital |

Not always the easiest way to loan money for your business Inconsistent support for customers Not suitable for higher-risk industries Can suddenly shut down your account |

PayPal Pricing

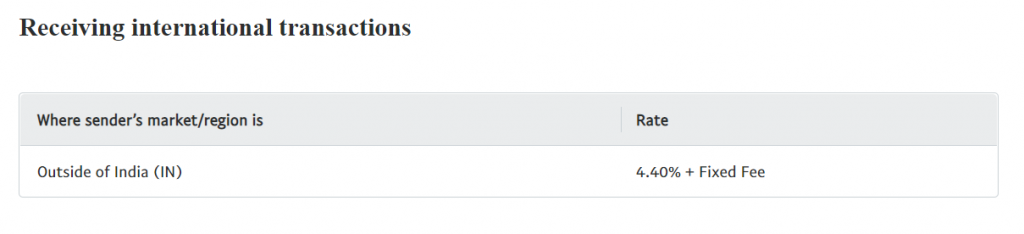

1. Commercial Transaction Rates

When you buy or sell goods or services, make any other commercial type of transaction, send or receive a charity donation or receive a payment when you “request money” using PayPal, we call that a “commercial transaction”.

2. Alternative Payment Method Rates

We may allow your customers to choose any of the alternative payment methods (APM) listed in our APM agreement at checkout to pay you for purchases.

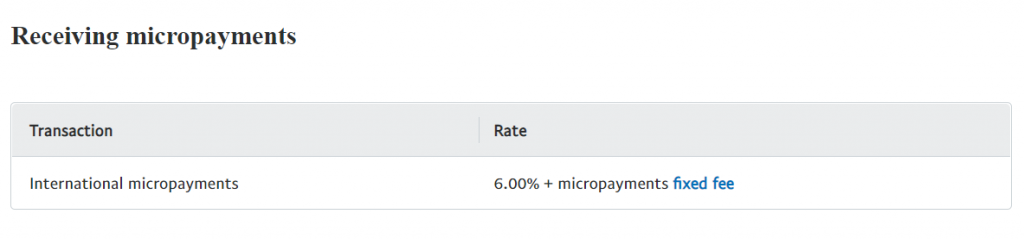

3. Micropayments

Subject to application and pre-approval by PayPal, you may upgrade an existing account to receive the Micropayment rate. Micropayment rates can be ideal as an alternative to standard commercial transaction rates for businesses that process small payments. If you upgrade to the Micropayment rate, this rate will apply to all commercial transaction payments received into your PayPal account. You need to contact them to apply for the Micropayment rate.

4. Dispute Fees

We may charge a Dispute Fee when a buyer files a dispute claim or chargeback for a transaction that was processed through the buyer’s PayPal account or a PayPal checkout solution. Please see the User Agreement for more information about Standard and High Volume Dispute fees.

Dispute fees will be applied in the currency of the original transaction.

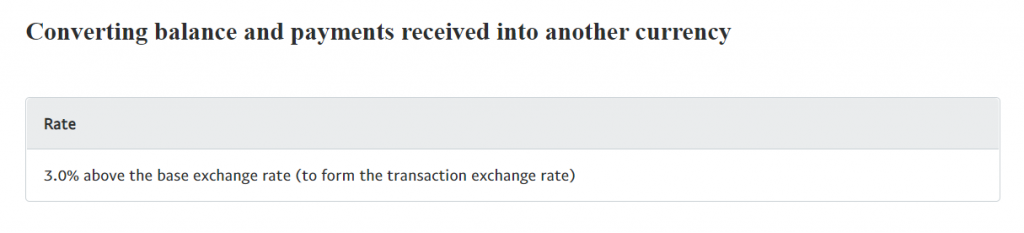

Currency Conversions

For information about how we convert currency, please see the user agreement.

The transaction exchange rate used for your currency conversion includes a fee which we charge above the base exchange rate. The fee depends on the type of currency conversion, as follows:

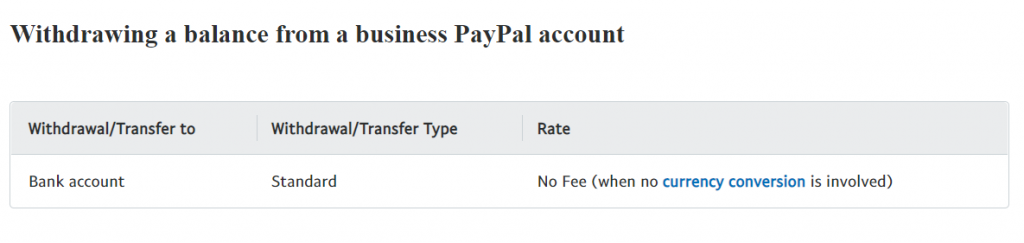

Withdrawals Out of PayPal

You can typically withdraw money out of PayPal by standard withdrawals/transfers to your linked bank account or eligible cards. A currency conversion (and currency conversion fees) may also apply.